- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

These 3 Dividend Stocks Just Raised Their Payouts. Are They Buys Here?

Dividend growth has picked up pace across a range of industries as companies work to reward shareholders amid mixed economic signals. In the semiconductor equipment sector, Lam Research Corporation (LRCX) announced its next quarterly dividend of $0.26 per share, up from $0.23, payable Oct. 15, 2025, to shareholders.

Meanwhile, Ingredion Incorporated (INGR) increased its quarterly payout to $0.82 per share on Aug. 27, 2025, a $0.02 rise from its previous $0.80, with payments scheduled for Oct. 1, 2025. In the industrial machinery space, Nordson Corporation’s board (NDSN) approved a 5% increase in its quarterly dividend to $0.82 per share, marking its 62nd straight yearly increase, payable Sept. 25, 2025, to shareholders.

More broadly, dividend increases continue to show resilience across the market as management remains confident in cash flows even while economic growth shows signs of slowing. With dividends rising across sectors from semiconductors to staples to industrials, investors face the question: after LRCX, INGR, and NDSN all raised dividends, is now the right time to add any of these income stocks to your portfolio? Let’s take a closer look.

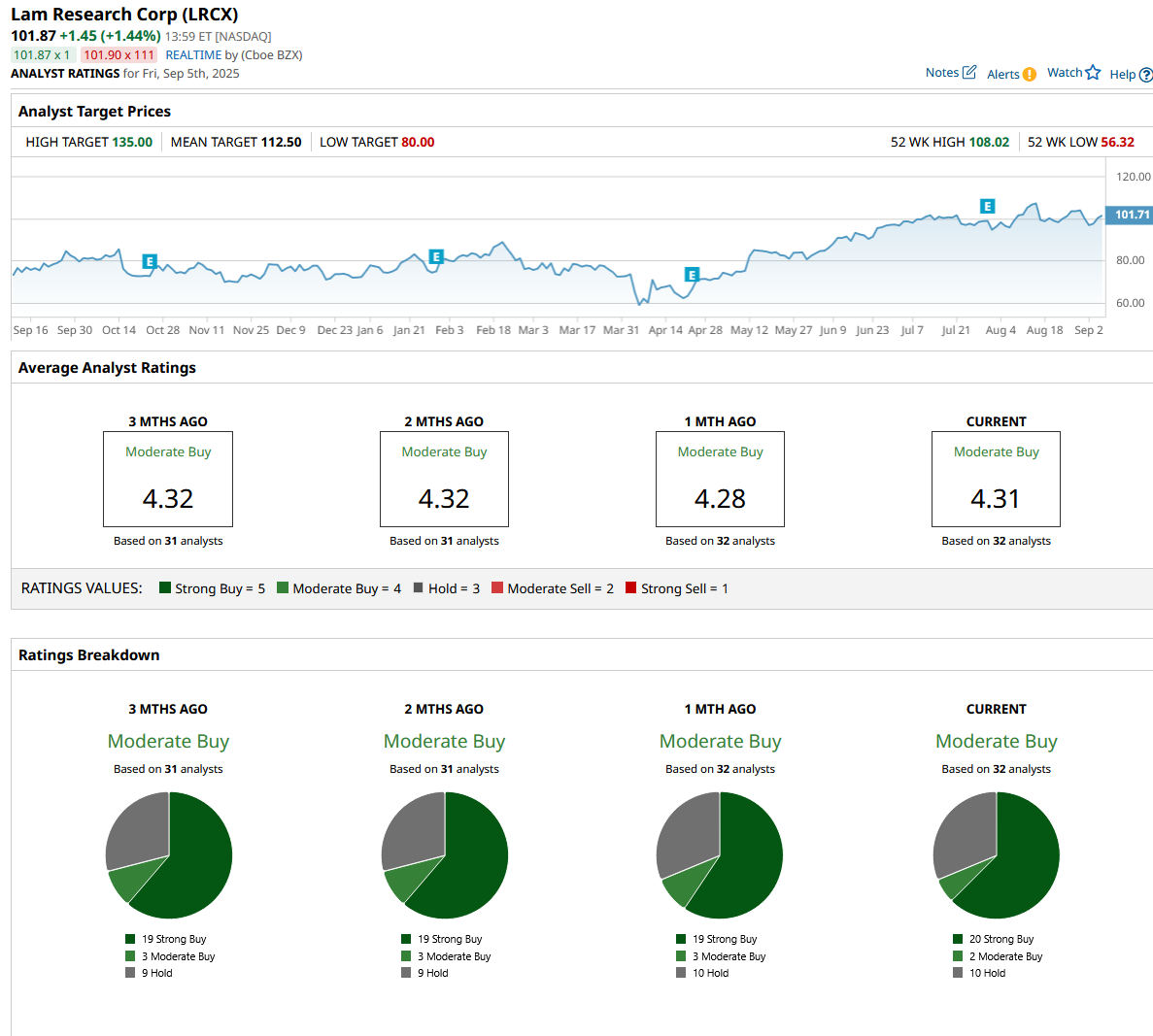

Lam Research Corporation (LRCX)

Lam Research Corporation is a major force in the semiconductor equipment industry, creating and supplying the tools needed to make advanced computer chips used in everything from smartphones to AI data centers.

Over the past year, Lam Research’s stock has climbed 34.72%, with a strong 41% gain so far in 2025, reflecting growing confidence in the demand for cutting-edge chips.

The company offers a dividend yield of 0.94% and has raised its dividend for 11 straight years. Its payout ratio of 23.38% signals that dividend growth is sustainable. Its forward price-to-earnings (P/E) of 21.97x, slightly below the technology sector average of 22.92x, suggests the stock is fairly valued compared to its peers and offers potential growth at a reasonable price.

In its latest quarter ending June 2025, Lam Research reported revenues of $5.17 billion and a gross margin of 50.1%, both higher than the previous quarter. Net income rose to $1.72 billion, or $1.35 per diluted share, up from $1.03 in the prior quarter. The company expects revenues around $5.2 billion next quarter, with earnings per share near $1.20, showing continued strength in its core business.

Lam Research continues to innovate, recently launching the ALTUS Halo tool that uses molybdenum for advanced chip production. This new technology is already being tested by leading chip manufacturers, cementing Lam’s role at the cutting edge of semiconductor metallization. Its investment in Zettabyte, a leading AI data center infrastructure firm, reflects a focus on supporting the growing AI market.

Analysts remain positive, with the 32 surveyed rating LRCX a consensus “Moderate Buy.” The average price target of $112.50 suggests about a 10.4% upside from the current stock price.

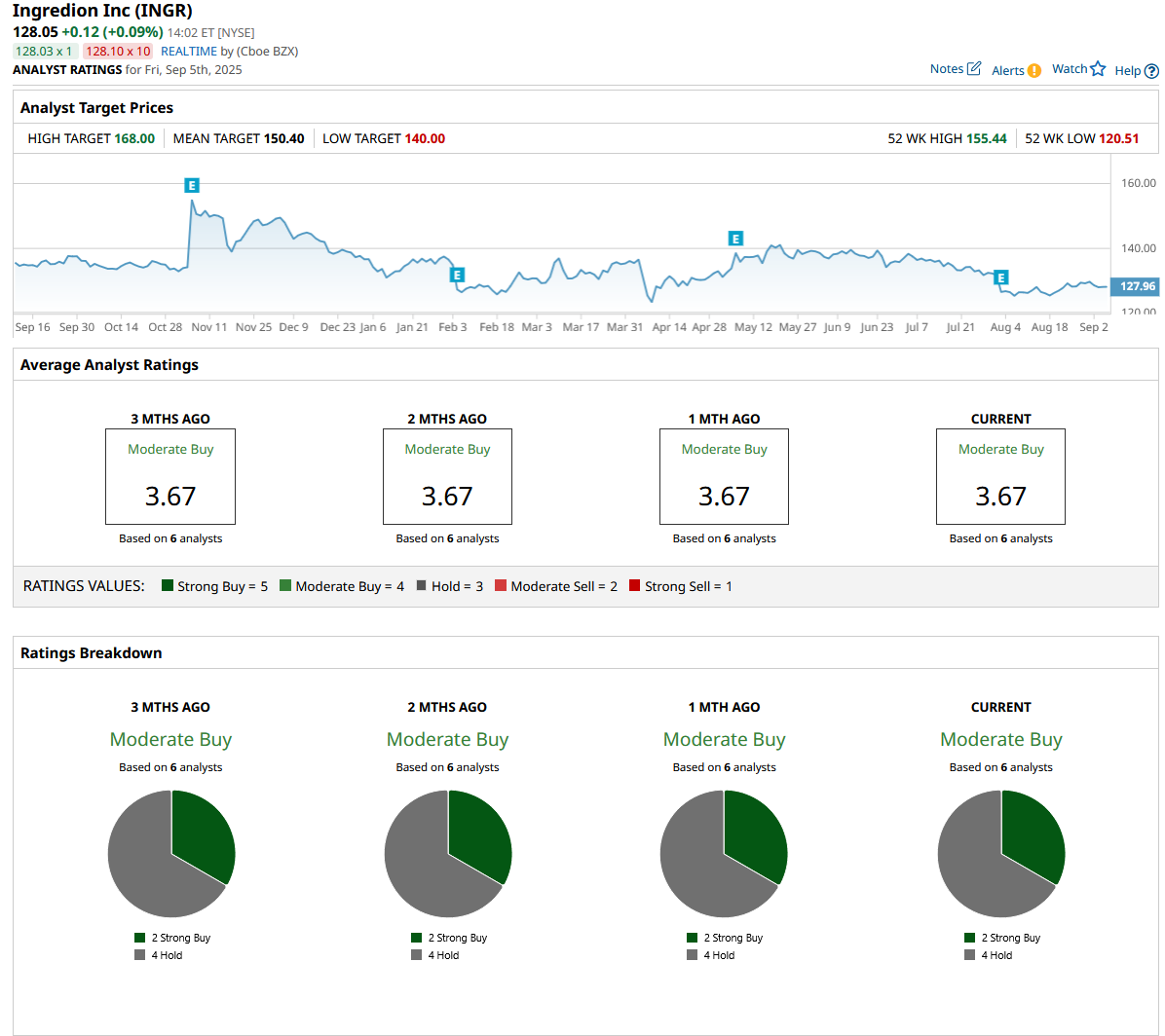

Ingredion Incorporated (INGR)

Ingredion Incorporated is a global ingredients company that supplies products for food, beverages, and industrial uses. They turn things like corn, tapioca, potatoes, and plant-based materials into ingredients such as sweeteners, starches, and proteins.

Over the last year, Ingredion’s stock has declined by 5.17%, and it’s down 7% so far this year, reflecting some challenges in the market.

Despite this, the company offers a dividend yield of 2.5%, backed by 15 consecutive years of increasing dividends and a payout ratio under 28%. Its forward P/E stands at 11.31x, well below the consumer staples sector average of 16.35x, indicating that the stock may be undervalued relative to its sector and could present a value opportunity for investors.

In the second quarter of 2025, Ingredion reported a 13% jump in operating income to $271 million, with adjusted operating income slightly higher at $273 million. Earnings per share rose notably to $2.99 from $2.22 in the previous year. The company also raised its full-year earnings forecast to between $11.25 and $11.75, signaling confidence in its future performance.

On the business front, Ingredion expanded its partnership with Univar Solutions to distribute plant-based and clean-label ingredients across the Benelux region, responding to rising demand for healthier food options.

Additionally, a $50 million investment to enlarge its Cedar Rapids facility will boost production of specialty starches used in packaging and papermaking, showing the company’s focus on growth beyond just food ingredients.

Analysts hold a positive view, with the six surveyed rating Ingredion a consensus “Moderate Buy.” The average price target stands at $150.40, suggesting roughly 17% upside from its current price.

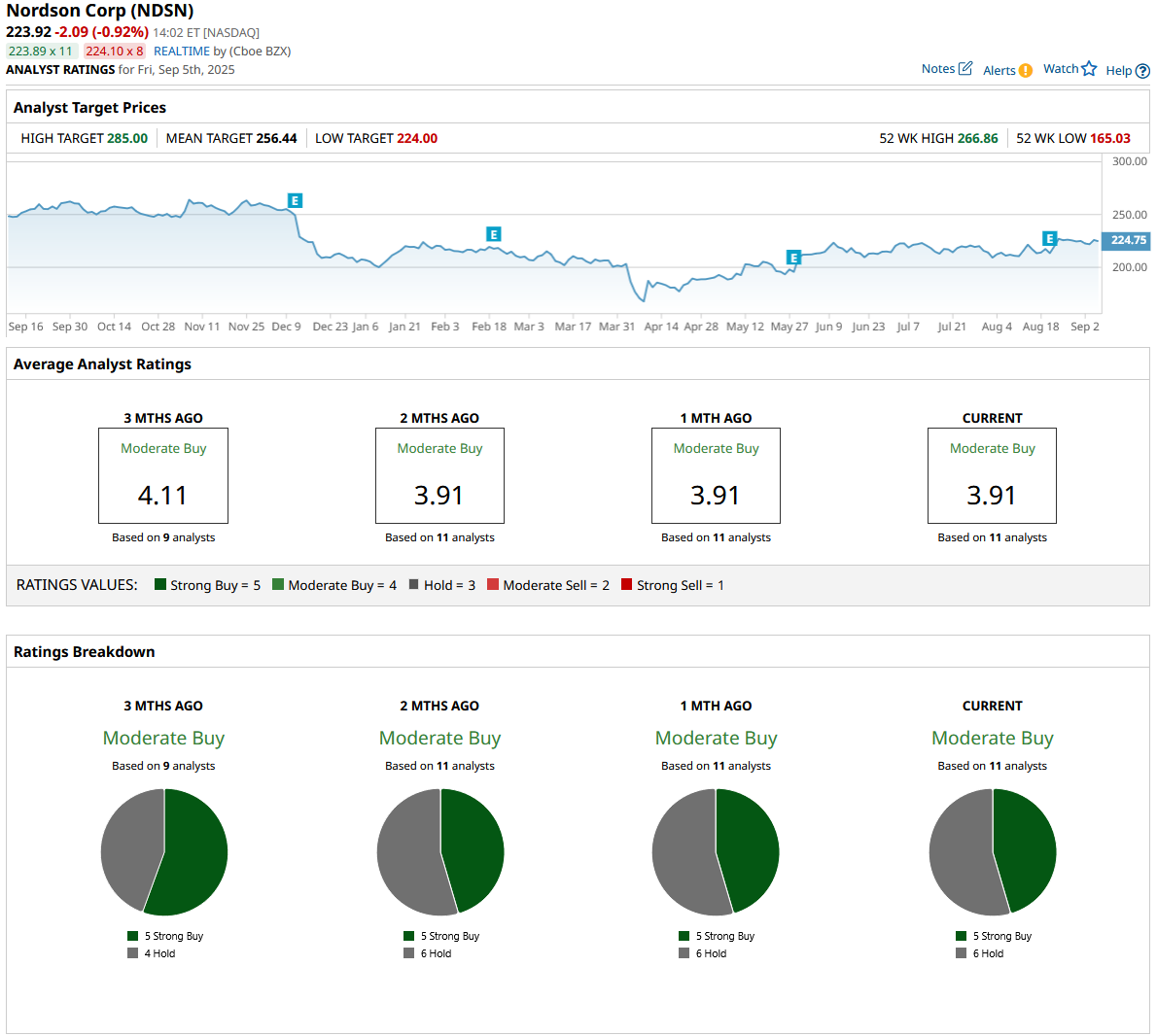

Nordson Corporation (NDSN)

Nordson Corporation is a global technology company that designs and manufactures precision systems and equipment used in many industries, including electronics manufacturing, medical devices, and general industrial applications.

Over the past year, NDSN stock has dipped by 8.85%, though it has gained 7.42% so far this year, showing some recovery after earlier declines.

The company offers a dividend yield of 1.04% and has increased dividends for 63 straight years. With a payout ratio under 30%, Nordson balances returning income to shareholders while keeping its finances healthy. It trades at a forward P/E of 21.96x, just above the industrials sector average of 20.63x, reflecting a modest premium likely due to its consistent dividend growth and stable earnings outlook.

In the third quarter of 2025, Nordson reported sales of $742 million, a 12% increase compared to the prior year. Adjusted earnings per share jumped 13% to $2.73, with net income reaching $126 million, or $2.22 per diluted share. Nordson also converted 180% of net income into free cash flow, reflecting efficient operations. The board approved a new $500 million share buyback program, signaling confidence in future growth.

Recent developments include Nordson Electronics Solutions’ new panel-level packaging technology, which helped Powertech Technology reach over 99% yield in semiconductor manufacturing, a key advance for the industry. Meanwhile, Nordson Medical is focusing on higher-value proprietary medical components after selling some contract manufacturing product lines to sharpen its growth strategy.

Analysts are positive on Nordson’s future, with all 11 surveyed giving it a consensus “Moderate Buy” rating. The average price target of $256.44 indicates roughly 15% upside from the current price.

Conclusion

Recent dividend hikes from Lam Research, Ingredion, and Nordson show that these companies are confident in their ability to generate steady cash flows even in uncertain times. Lam Research and Ingredion both show strong growth potential, while Nordson combines steady dividends with innovation. Shares of all three are likely to trend upward, making now a good time for income-focused investors to consider adding them to their portfolios.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.